Hospitals and healthcare providers are critical pillars in their communities, delivering much-needed care and wellness resources to the people they serve.

But just like any other business, healthcare organizations must fund the care they deliver. They rely on various sources of revenue to keep their facilities open and up to date, buy necessary medical supplies, invest in advanced equipment and compensate their clinical and administrative staff for the work they do each day.

Healthcare revenue cycle management (RCM) covers the business side of healthcare and includes all tasks associated with the management and collection of revenue generated by healthcare organizations from patient care episodes, from initial patient intake through complete payment collection.

Healthcare Revenue Cycle Basics

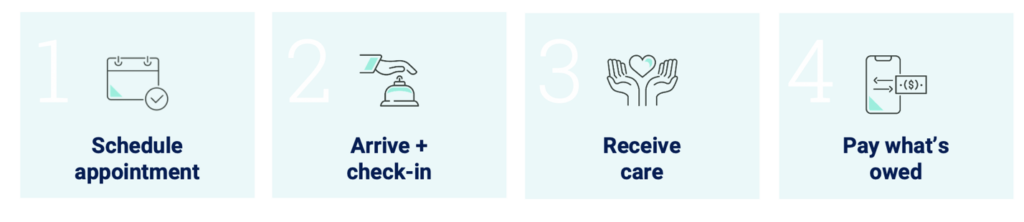

The healthcare revenue cycle starts as soon as the patient’s care journey begins with scheduling an appointment or hospital visit. It concludes once the healthcare provider receives complete payment from insurance companies, the patient or both, for the care they delivered.

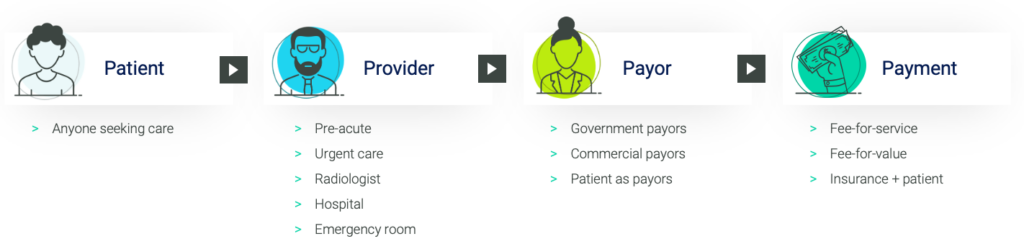

There are four Ps in the revenue cycle ecosystem:

-

- Patient (which you’ve likely been at one point).

- Provider is a term used for healthcare organizations and their practitioners across all types of care settings, from physician offices to hospitals to long-term care facilities.

- Payor typically refers to one of the more than 1,600 insurance companies responsible for reimbursing providers for the care delivered to their members. This includes government entities like Medicare and Medicaid and commercial insurance companies like Blue Cross Blue Shield and Cigna.

- Payment can be structured in a variety of ways based on the types of contracts established between the payors and providers, including traditional fee-for-service contracts, where providers collect payment based on the services they deliver, and value-based care contracts where payment depends on the quality of care delivered and the sustained health of the covered patients.

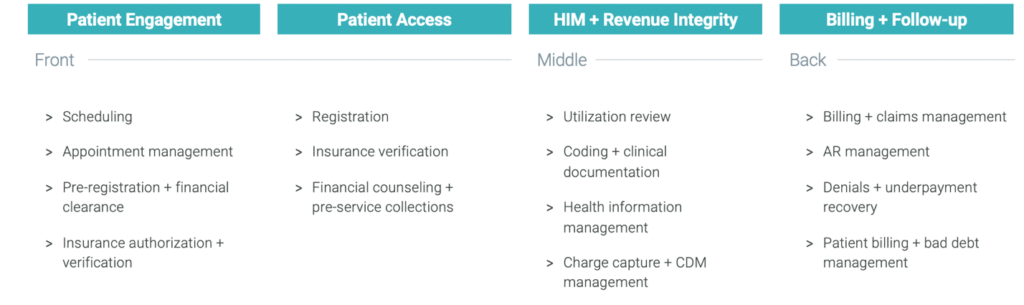

What is Revenue Cycle Management?

Healthcare revenue cycle management involves the orchestration of thousands of tasks that occur throughout the four main stages of the patient’s care journey:

-

- Scheduling

- Registration

- Care Delivery + Documentation

- Billing + Collections

Successful revenue cycle management provides a positive experience for patients and ensures providers get paid exactly what they are owed for the services they deliver.

Here’s a summary of what’s going on in the revenue cycle during an episode of care:

Step 1: Scheduling an Appointment.

In the revenue cycle, this is known as pre-arrival services.

During this step, key information is collected from the patient and documented in the provider’s electronic health record system. This information includes details about the appointment, the patient’s identification, and health insurance coverage and is critical to building an accurate final bill. We’ll dive into that more during the billing and collections phase.

Specific revenue cycle functions in Pre-Arrival Services include:

-

- Digital Patient Engagement

- Scheduling + Appointment Management

- Pre-registration + Financial Clearance

Step 2: Arrival + Intake

Referring to a patient’s initial encounter with the healthcare organization, this is called Patient Access.

When the patient arrives for their visit, their identity and health insurance coverage are reviewed and verified. Ideally, there is also a review to determine if the patient qualifies for any financial programs, if needed, to ensure all available avenues for financial assistance are provided to the patient.

Most healthcare organizations also offer an estimate of a patient’s financial responsibility, or what they will owe for their visit. They can also provide financial counseling to help patients understand their health insurance coverage and provide the opportunity to make an upfront payment or establish payment plans before they leave to help streamline the billing process and eliminate financial uncertainty.

Specific revenue cycle functions in Patient Access include:

-

- Registration

- Financial Clearance

- Point-of-service Patient Collections

- Financial Counseling (for uninsured + underinsured patients)

Step 3: Care Delivery + Documentation

This is known as “the critical middle” or the revenue integrity function.

When the patient receives care, the clinical staff document the visit, including procedure and diagnosis details. This documentation is translated into standard alpha-numeric codes, which are then associated with charges defined in the provider’s charge description master (CDM) – a database of costs associated with every item, service and supply available within the facility.

The specificity of procedure and diagnosis codes, substantiated by thorough clinical documentation, significantly impacts what the provider will ultimately be paid – hence the RCM moniker “critical middle.”

During patient care delivery, teams continually monitor the patient’s status and treatment plan to ensure they receive the right amount of care at the right time in the right setting. Just as failure to obtain required prior authorization can result in lack of payment, so can delivering care that’s not deemed medically necessary by the health insurance plan. For example, if a patient stays longer than three days in the hospital for a knee replacement surgery that has no additional complications that would medically require a longer stay, the payor could deny the bill because the standard of care for knee replacements dictates that a patient should only stay for three days or less.

Specific revenue cycle functions in Revenue Integrity or Mid-Revenue Cycle include:

-

- Health Information Management (HIM)

- Coding

- Clinical Documentation Improvement (CDI)

- Utilization Review

- Charge Description Master (CDM) Management

- Charge Capture

Step 4: Medical Billing + Collections

The final phase of the revenue cycle management process is known as “the back end” or business office.

This phase covers all activity related to claims management and collecting payments from both health insurance companies and patients based on their financial responsibility.

A medical bill begins as a claim, which contains all information necessary to receive payment for the services rendered by a healthcare organization, including patient demographics, medical codes and charges. The claims management function involves reviewing each claim for accuracy and submitting claims to the appropriate payors for reimbursement.

Revenue cycle teams monitor the status of submitted claims to ensure they collect the money owed for accounts receivable (AR) in a timely manner. The accuracy of the claim, effectiveness of AR follow-up and scrutiny of remittance (or payment received) all impact the speed and accuracy of insurance reimbursement.

Payment delays can occur because of issues like claim denials and underpayments, which cause costly rework to be resolved. Claim rejections and denials occur when the payor disagrees with the charges or requires more information or different submission specifications to process the claim.

Underpayments occur when payors don’t reimburse the full amount owed for services rendered or when providers commit coding or documentation errors that lead to incomplete or incorrect billing for the delivered care.

Once insurance has paid its portion of the claim, remaining patient balances are routed to teams that specialize in collecting patient payments. If patient collections are unsuccessful after a certain period, they are often referred to a debt collection agency, and the balance is considered bad debt.

Specific revenue cycle functions in the Medical Billing and Collections process include:

-

- Claims Management

- Billing

- Insurance Accounts Receivable

- Patient Financial Services

- Denials Management

- Underpayment Recovery

- Bad Debt Collections

Common Revenue Cycle Management Challenges

Unfortunately, the healthcare revenue cycle is an error-prone process with hundreds of data handoffs and complex rules, making it incredibly challenging to capture proper reimbursement while ensuring a positive patient experience.

Complications that arise in the revenue cycle can result in costly setbacks for healthcare organizations, including decreased patient satisfaction, and therefore, patient volume, regulatory audits and fines due to non-compliant practices and delayed or lost revenue due to denials, underpayments, uncollected AR and bad debt.

Common revenue cycle management challenges for healthcare organizations include:

Overwhelming Complexity

Effective revenue cycle management requires in-depth knowledge of more than 70,000 medical codes used to document care, thousands of line-item charges in CDMs and thousands of pages of payor policies.

According to the American Hospital Association, there are more than 130,000 pages of Medicare rules and regulations, most of which cover how to submit claims for payment. Payor rules can change by the day, with tens of thousands of policy updates issued each year. Healthcare providers must understand every rule, monitor and interpret changes, then adjust systems and amend processes as needed to accommodate payor requirements.

Lack of Experienced Resources

Labor shortages and the global talent pool of a remote workforce have made it difficult for healthcare providers to fill even entry-level positions in revenue cycle departments, let alone highly specialized senior positions.

A lack of adequate, accessible and up-to-date training limits the ability of providers to up-skill staff or train new hires to manage complex RCM tasks.

When short-staffed, employees often wear multiple hats, which diminishes performance and prevents functions from being managed to the level of specificity required to avoid revenue loss.

Disjointed Systems + Error-prone Processes

The average healthcare organization’s revenue cycle is often fraught with disconnected systems, data silos and manual processes. This disconnect and inefficiency make it difficult to cohesively manage operations, accurately pinpoint systemic issues and effectively manage costs associated with collecting revenue.

Processing errors or inaccurate data at any point throughout the revenue cycle can lead to delayed reimbursement, lost revenue or regulatory compliance risk for providers. Unnecessary rework to fix errors and reprocess claims requires valuable resources and decreases productivity.

Disparate systems and information silos make it difficult to gather, normalize and analyze data. This data helps to assess financial and operational performance, identify trends and patterns to strengthen rule sets or fuel machine learning algorithms and ensure accurate reimbursement.

What Are the Key Components of a Successful Revenue Cycle Management Program?

The most successful healthcare revenue cycle management programs focus on expert revenue orchestration with the proper technique, talent and technology, underscored by a constant focus on patient connectivity.

Technique

Tried and true best practices are critical to a well-run RCM operation. A clear understanding of the revenue cycle as a system allows expert operators to break down traditional silos and streamline processes, taking lessons learned from trillions of transactions to bridge data gaps across departments and eliminate inefficiency.

Talent

Experienced and capable talent is at the core of every good RCM program. Staying ahead of the pace of change and adapting to the complex RCM environment requires competent leadership, specialized experts, well-trained staff and a highly collaborative work environment. Best practices must be well documented and hardwired into evergreen training tools and resources to ensure everyone is operating at the top of their license.

Technology

Working smarter by leveraging modern technology and true business intelligence is essential for a successful RCM function. The right RCM technology can help automate repetitive manual tasks, prioritize exception-based workflows and continually learn from patterns to detect anomalies and prevent errors. In addition, the right technology can provide robust business intelligence to guide strategic decision-making and reveal insights into performance.

In Summary

While expert revenue cycle management may be outside most healthcare organizations’ core competency, it’s critical to their missions, nonetheless. They often lack the capabilities to efficiently manage and optimize their revenue cycle operations because the complexity requires a degree of operational expertise and scaled investments in talent and technology that many health systems struggle to prioritize. Luckily, healthcare providers have a range of options to drive successful revenue cycle management, from low-commitment operational assessments to end-to-end revenue cycle management with an experienced partner.

According to one healthcare organization CEO, “There’s only so many levers of opportunity for improvement in margin right now, so if you’re not focusing on your revenue cycle, you’re really missing one of the biggest opportunities out there to make an impact on your system.”