The first quarter of 2022 was the worst financial quarter in history for hospitals. Now they’re collapsing under their own weight while payors are raking in profit.

“We’re in a position where I don’t think anyone can help us. We need to sell all seven hospitals and we need to do it quickly.” This realization was shared by a community health system’s board member and interim CEO, but the story is not unique.

Hospitals are under unbearable financial pressure with no end in sight, forcing them to cut services or close altogether. Communities are the ones paying the price.

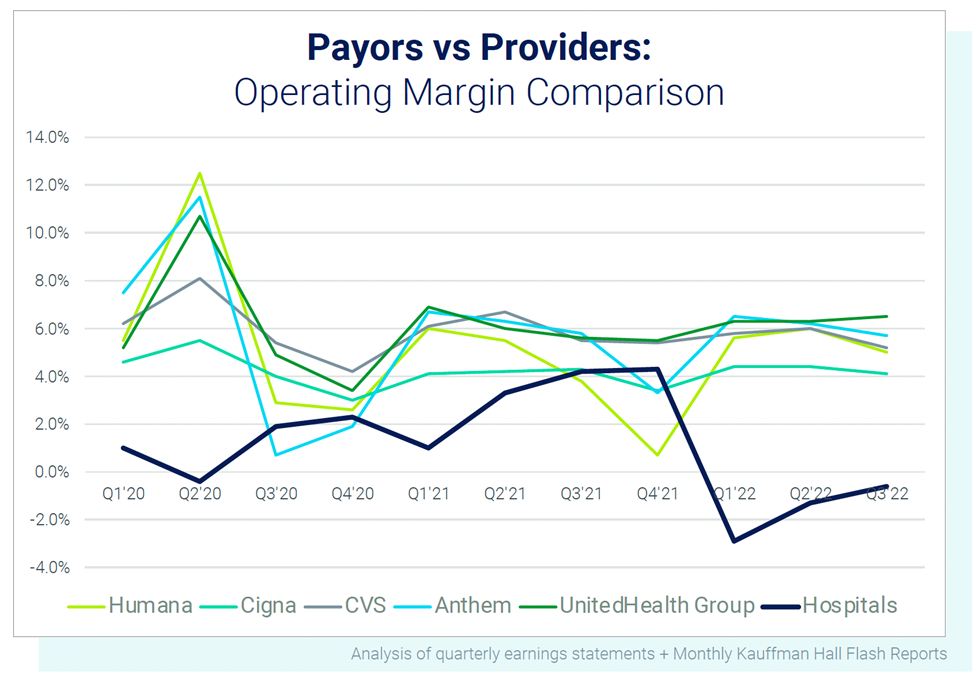

Hospital operating margins are 40% lower than last year, leaving two out of five rural hospitals at risk of closure when more than 46 million people living in rural areas already face significant healthcare shortages.

Healthcare leaders anticipate seeing a record number of hospital closures in the next six months with turmoil continuing for at least the next two years.

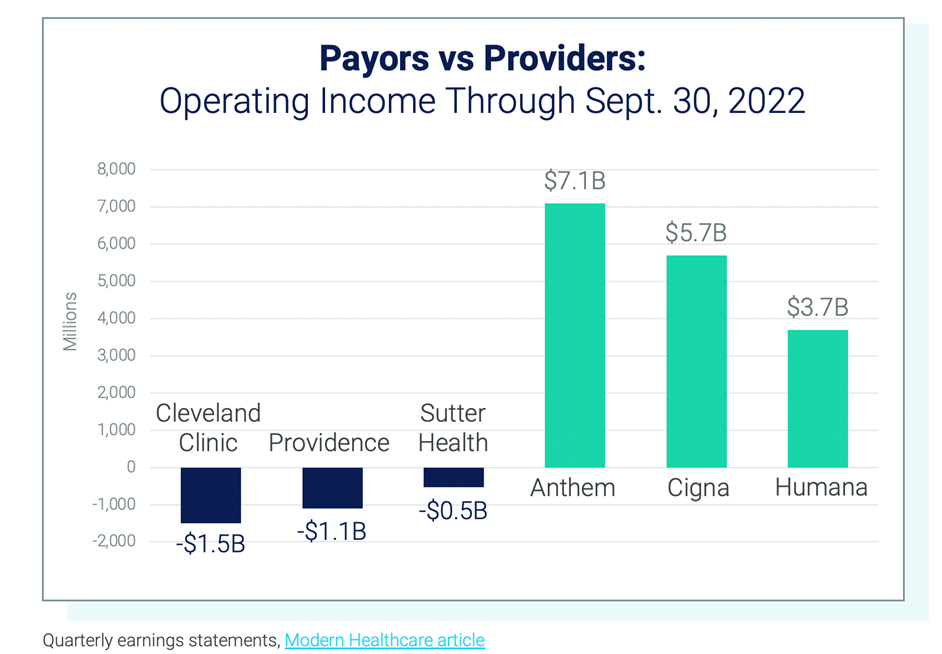

Even the largest health systems are reporting multibillion-dollar losses. Cleveland Clinic’s net losses have exceeded $1.5 billion so far this year and other large systems like Tenet Healthcare and HCA Healthcare reported a 50% or more decrease in profit for the first half of 2022 compared to 2021.

Payors are Paying Out Billions in Dividends

So how are health insurance companies expecting to close the year? With operating margins above 4%, operating cash flow double what it was last year and more than $4 billion being paid to shareholders in the first half of this year.[1]

What’s Causing the Financial Strain for Hospitals?

Declining reimbursement due to Medicare sequestration, advanced payment recoupment, and limited CARES Act funding combined with skyrocketing labor expenses and a weak investment market have left health systems with little to no financial flexibility and increasing uncertainty about the path forward.

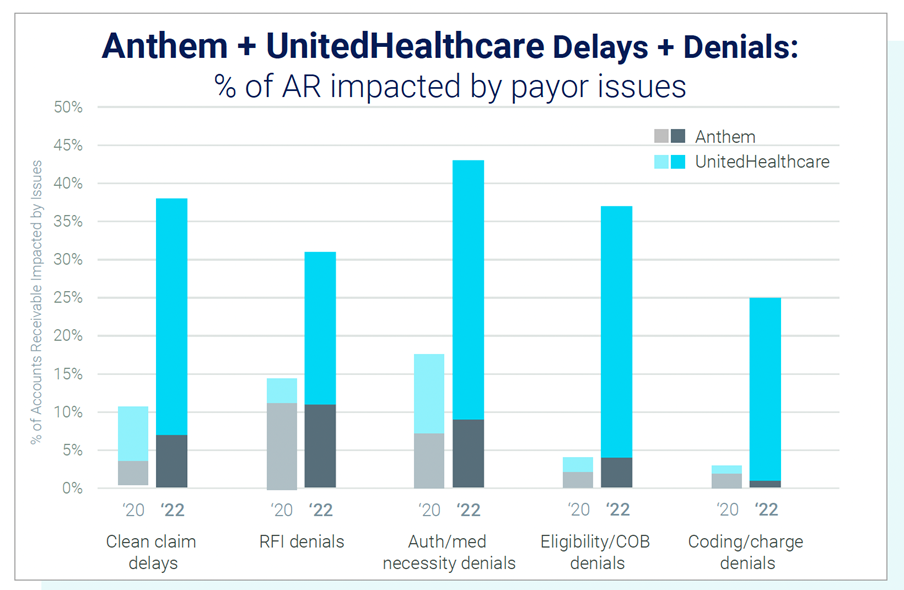

Payors are also exacerbating the financial strain on providers by increasingly delaying and denying payments. Nearly 67% of healthcare leaders report an increase in claim denials over the past year, according to a Kaufman Hall report.

Major trends include delays related to prior authorization and eligibility validation as well as denials requiring more claim detail be provided to the payor.

Accurate claims are taking three times longer to process now than they did pre-COVID, and initial denials are increasing at an alarming rate based on an analysis by Ensemble Health Partners across more than 200 hospitals.

“From our clients’ perspective, unacceptable payor behavior has grown by 6%, which translates into a multiple-million-dollar delay in net revenue for these organizations,” explained Shannon White, chief operating officer at Ensemble Health Partners.

Payors are Investing in Technology for Increased Claim Scrutiny

According to a report by Guggenheim Securities, payors are expected to increase their investment in payment integrity technology by 30% over the next three years including in the areas of claims editing, inpatient claims review and clinical validation.

This increased scrutiny will add to the growing volume of denials related to requests for information and will continue drawing out claim authorization timeframes, which are already seven times longer than they were prior to the pandemic.

Payors are counting on this strategy for huge returns. Optum estimates $326 billion in cost savings as a result of their enhanced payment integrity capabilities and Anthem reported $300 million in savings in 2020 from their anomaly detection tool.

Hospitals are Looking for a Path Forward

The disparity in profitability between payors and providers has reached a critical mass and is creating barriers to healthcare innovation and the effective transition to true population health.

How will hospitals survive the mounting pressure? They won’t. At least not as they’re run today. Healthcare CEOs and CFOs are turning to new approaches to address current challenges including diversifying revenue streams, capitalizing on intellectual property, making strategic investments and strengthening revenue protection.

Read more about the top three strategies hospital executives are deploying to overcome financial instability.

[1] https://content.naic.org/sites/default/files/inline-files/health-2022-mid-year-industry-report.pdf

These materials are for general informational purposes only. These materials do not, and are not intended to, constitute legal or compliance advice, and you should not act or refrain from acting based on any information provided in these materials. Neither Ensemble Health Partners, nor any of its employees, are your lawyers. Please consult with your own legal counsel or compliance professional regarding specific legal or compliance questions you have.