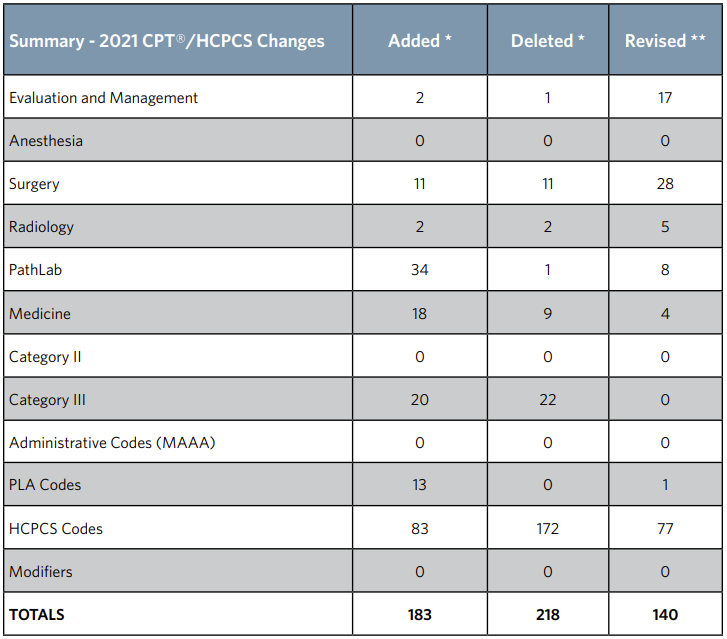

CPT Annual Update

CMS 2021 Code Set Updates

To access the CY 2021 OPPS Addenda visit www.cms.gov.

Medicare Coinsurance and Premium Amounts for 2021

2021 Part A

Hospital Insurance (HI)

- Part A Deductible – $1,484

- Part A Coinsurance – $371 a day for 61st – 90th days

- Part A Coinsurance – $742 a day for 91 and beyond (lifetime reserve days) Base Premium (BP)

- Part A Base Premium – $471 a month

2021 Part B

Supplementary Medical Insurance (SMI)

- Part B Standard Premium – $148.50 a month

- Part B Deductible – $203 a year

- Coinsurance – 20%

340B Program

Section 340B of the Public Health Service Act (340B) allows participating hospitals and other providers to purchase certain covered outpatient drugs at discounted prices from manufacturers.

Section 340B of the Public Health Service Act (340B) allows participating hospitals and other providers to purchase certain covered outpatient drugs at discounted prices from manufacturers.

Beginning January 1, 2018, Medicare adopted a policy to pay an adjusted amount of ASP minus 22.5 percent for certain separately payable drugs or biologicals that are acquired through the 340B Program.

Litigation

- Lower court ruled CMS exceeded statutory authority in adjusting the payment rate for 340B drugs.

- August 2020, the U.S. Court of Appeals for the District of Columbia Circuit reversed the lower district court’s ruling and held that CMS reasonably interpreted the Medicare statute and had the authority to implement rate reductions under its general adjustment authority

- CMS conducted a survey to collect data for drug acquisition cost during CY2018 and CY2019

Additional Details

Proposing to pay for 340B drugs at ASP minus 34.7 percent, plus an add-on of 6 percent of the ASP.

This results in a net payment rate of ASP minus 28.7 percent for 340B drugs.

For biosimilars, CMS is proposing to set net reimbursement at ASP minus 28.7 percent of the biosimilar’s ASP, not minus 28.7 percent of the reference product’s ASP.

Presented alternative proposal of continuing the current Medicare payment policy of paying ASP-22.5 percent for 340B- acquired drugs for CY 2021 and subsequent years.

Proposing that rural sole community hospitals, children’s hospitals, and PPS-exempt cancer hospitals be excepted from either of the proposed 340B payment policies and that these hospitals would continue to report informational modifier “TB” for 340B-acquired drugs and continue to be paid ASP+6 percent.

Price Transparency

In 2010, the ACA initiated discussions around Price Transparency which lead to the 2015 proposed rule, requesting hospitals provide a method to make Chargemaster pricing available to consumers. The 2019 Final Rule required hospitals to make available

a standard list of charges effective January 1, 2019 and update the information at least annually. An executive order signed by President Trump outlined additional guidelines developed in preparation for the CY20 final rule, expanding the requirements

to include shoppable services and a machine-readable file inclusive of payer contracted rates. Outlined in the bullet points below are the CMS final requirements for providing standard charges in two ways:

- A machine-readable file online that includes all standard charges (including gross charges, discounted cash prices, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges) for all hospital items and services

- A consumer-friendly display of shoppable services including discounted cash prices, payer-specific negotiated charges, and de-identified minimum and maximum negotiated charges for at least 300 ‘shoppable’ services (70 CMS-specified and

230 hospital-selected).

As an alternative to publicly displaying the 300 shoppable services, CMS will consider hospitals who use and maintain an internet-based price estimator tool to be compliant if the estimator:

- Provides estimates for at least 300 shoppable services, including 70 from CMS

- Includes Physician and Practitioner estimates for services rendered for employed professional

- Does not require a patient to register or sign-up

- Is accessible from the front page of the hospital website

In addition to posting the two new standard charge files, CMS also released their definitions of “hospital”, “standard charges”, and “items and services”, along with their plan for monitoring hospital noncompliance

which include issuing a warning notice, requesting a corrective action plan, imposing civil monetary penalties and publishing the penalty on a CMS website. In FY21, the proposal additionally requires Medicare cost reports to include the median health

plan-specific negotiated rates by MS-DRG for Inpatient services.

Level of Supervision of Outpatient Therapeutic Services

2020 OPPS Final Rule, CMS finalized their proposed policy to change the “generally applicable minimum required level of supervision for hospital outpatient therapeutic services from direct supervision to general supervision for services furnished

by all hospitals and CAHs.” General supervision means that the procedure is furnished under the physician’s overall direction and control, but that the physician’s presence is not required during the performance of the procedure.

March 31, 2020 CMS issued interim final rule with comment period (IFC) to give providers “needed flexibilities to respond effectively to the serious public health threats posed by the spread of the COVID-19.”

Specific to the level of supervision the following policies were adopted in the IFC to be effective for the duration of the Public Health Emergency (PHE) due to COVID-19:

- A policy to reduce the minimum default level of supervision for non-surgical extended duration therapeutic services (NSEDTS) to general supervision for the entire service, including the initiation portion of the service, for which CMS previously required

direct supervision on initiation of the service. - A policy indicating that the requirement for direct supervision of pulmonary, cardiac and intensive cardiac rehabilitation services includes virtual presence of the physician through audio/video real-time communications technology when use of such

technology is indicated to reduce exposure risks for the beneficiary or health care provider.

CMS has decided that these policies are appropriate outside of the PHE and are proposing to adopt them for CY 2021 and beyond.

New Technology Pass Through Payments

In the proposed rule each year, CMS addresses the applications for new technology add-on payments under the IPPS by presenting its evaluation and analysis of the applications. CMS describes any concerns they may have about whether a technology meets the criteria for payment as a new technology and seeks additional information as needed for use in making-a-decision on the applications in the final rule.

Current criteria for a device to be eligible for transitional pass-through payment under OPPS:

- If required by FDA, the device must have received FDA approval or clearance (except for a device that has received an FDA investigational device exemption (IDE) and has been classified as a Category B device by the FDA), or meet another appropriate FDA exemption.

- The pass-through payment application must be submitted within 3 years from the date of the initial FDA approval or clearance.

- The device is determined to be reasonable and necessary for the diagnosis or treatment of an illness or injury or to improve the functioning of a malformed body part, as required by section 1862(a)(1) (A) of the Act.

- The device is an integral part of the service furnished, is used for one patient only, comes in contact with human tissue, and is surgically implanted or inserted (either permanently or temporarily), or applied in or on a wound or other skin lesion. CMS presents 24 new applications for new technology add-on payment for FY 2021. Three technologies were submitted by applicants as a new medical device that is part of the FDA Breakthrough Devices Program and six technologies were submitted by applicants as a product that received FDA Qualified Infectious Disease Product (QIDP) designation. CMS is proposing to approve these nine alternative pathway applicant technologies. The remaining 15 technologies were submitted by applicants under the traditional new technology add-on payment pathway criteria. CMS proposes to continue the new technology add-on payments for 10 of the 18 technologies currently receiving the add-on payment.

CMS presents 24 new applications for new technology add-on payment for FY 2021. Three technologies were submitted by applicants as a new medical device that is part of the FDA Breakthrough Devices Program and six technologies were submitted by applicants as a product that received FDA Qualified Infectious Disease Product (QIDP) designation. CMS is proposing to approve these nine alternative pathway applicant technologies. The remaining 15 technologies were submitted by applicants under the traditional new technology add-on payment pathway criteria. CMS proposes to continue the new technology add-on payments for 10 of the 18 technologies currently receiving the add-on payment.

Ambulatory Surgery Centers: Procedure Converge Expansion

For CY 2021, CMS is adding eleven procedures

to the ASC covered procedures list under their

standard review process. One of the newly added

procedures is CPT 27130, total hip arthroplasty.

This final rule will further advance the commitment

to strengthening Medicare and reducing provider

burden so that ambulatory surgical centers can

operate with increased flexibility, and patients are

better equipped to be active healthcare consumers.

CMS is revising the criteria they use to add covered surgical procedures to the ASC covered procedure list. Certain criteria that CMS used to add covered surgical procedures to the ASC covered procedure list in the past will now be factors for physicians

to consider in deciding whether a specific beneficiary should receive a covered surgical procedure in an ASC. They also are adopting a notification process for surgical procedures the public believes can be added to the ASC covered procedure list

under the criteria CMS is retaining. CMS has added an additional 267 surgical procedures to the ASC covered procedure list for CY 2021 using their revised criteria.

Prior Authorization

Prior authorization is a process through which a request for provisional affirmation of coverage is submitted for review before the service is rendered to a beneficiary and before a claim is submitted for payment.

Prior Authorizations will be processed beginning June 17th for dates of service on or after July 1, 2020. The regulatory requirements were finalized as part of the Hospital Outpatient Prospective Payment System Final Rule, published in the Federal

Register on November 12, 2019.

Update 6/15/2020:

- CMS is removing HCPCS code 21235 (Obtaining ear cartilage for grafting) from the list of codes that require prior authorization as a condition of payment, because it is more commonly associated with procedures unrelated to rhinoplasty that are not

likely to be cosmetic in nature.

The following hospital OPD services will require prior authorization when provided on or after July 1, 2020 and will continue in 2021:

- Blepharoplasty

- Botulinum toxin injections

- Panniculectomy

- Rhinoplasty

- Vein ablation

For the complete list of codes that will require prior authorization as a condition of payment please click HERE or visit:

https://www.ensemblehp.com/wp-content/uploads/attachments/cpi-opps-pa-list-services.pdf

2021 Physician E/M CPT Code Changes

CY2021 has the first major change in E & M coding in over 25 years. Clinicians may now use straightforward medical decisions OR time when selecting an office visit code.

The level 1 new patient office visit code, 99201, has been deleted and the replacement code is the existing level 2 new patient code, 99202. The new patient office visit codes, 99202 – 99205, now have verbiage that states “office or other outpatient visit for the evaluation and management of a new patient, which requires a medically appropriate history and/or examination and straightforward medical decision making. When using time for code selection, xx – xx minutes of total time is spent on the date of the encounter.” Each code has a specific number of minutes.

The description for the established patient level 1 office visit code, 99211, has also been revised. The total time has been removed from the verbiage. This code is now used for established patients when the presenting problems are minimal. This is the only office visit code that does not have time specified. The other established patient office visit codes, 99212 – 99215, had description revisions as well. The verbiage now states “office or other outpatient visit for the evaluation and management of an established patient, which requires a medically appropriate history and/or examination and straightforward medical decision making. When using time for code selection, xx – xx minutes of total time is spent on the date of the encounter.” Each code has a specific number of minutes.

Inpatient Only Procedures

First introduced 20 years ago, the Medicare inpatient only list designates surgeries that require inpatient care because of the invasive nature of the procedure, the need for at least 24 hours of postoperative recovery time, or the underlying physical condition of the patient requiring the surgery. These procedures have a Medicare status indicator of “C”.

In the 2021 rule, CMS is finalizing their proposal to eliminate the Inpatient Only (IPO) list over a three-year transitional period with the list completely phased out by CY2024. The phase out plan will begin with the removal of approximately 300 primarily musculoskeletal-related services. This will make these procedures eligible to be paid by Medicare in an outpatient hospital setting as well as the inpatient setting when inpatient care is appropriate, as determined by a physician.

Procedures removed from the IPO list may become subject to medical review activities related to the 2-midnight rule. CMS is finalizing a policy in the CY2021 rule in which procedures removed from the IPO list beginning January 1, 2021 will be indefinitely exempted from site-of-service claim denials under Medicare Part A, eligibility for Beneficiary and Family-Centered Care-Quality Improvement Organization referrals to RACs for noncompliance with the 2-midnight rule, and RAC reviews for “patient status”. CMS states that this exemption will last until they have Medicare claims data indicating that the procedure is more commonly performed in the outpatient setting than the inpatient setting.

COVID-19 VACCINES AND MONOCLONAL ANTIBODIES

The CPT Editorial Panel has approved a unique CPT code for each of the two coronavirus vaccines as well as administration codes to each vaccine. The new CPT codes clinically distinguish each coronavirus vaccine for better tracking, reporting and analysis

that supports data-driven planning and allocation.

Category I CPT codes and descriptors:

91300

- Severe acute respiratory coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) vaccine, mRNA-LNP, spike protein, preservative free, 30 mcg/0.3mL dosage, diluent reconstituted, for intramuscular use

91301

- Severe acute respiratory coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) vaccine, mRNA-LNP, spike protein, preservative free, 100 mcg/0.5mL dosage, for intramuscular use

The CPT Editorial Panel has worked with CMS to create new vaccine administration codes that are both distinct to each coronavirus vaccine and the specific dose in the required schedule. These CPT codes report the actual work of administering the vaccine,

in addition to all necessary counseling provided to patients or caregivers and updating the electronic medical record.

Administration CPT codes and descriptors:

0001A

- Immunization administration by intramuscular injection of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) vaccine, mRNA-LNP, spike protein, preservative free, 30 mcg/0.3mL dosage, diluent reconstituted; first dose

0002A

- Immunization administration by intramuscular injection of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) vaccine, mRNA-LNP, spike protein, preservative free, 30 mcg/0.3mL dosage, diluent reconstituted; second dose

0011A

- Immunization administration by intramuscular injection of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) vaccine, mRNA-LNP, spike protein, preservative free, 100 mcg/0.5mL dosage; first dose

0012A

- Immunization administration by intramuscular injection of severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]) vaccine, mRNA-LNP, spike protein, preservative free, 100 mcg/0.5mL dosage; second dose

In November 2020, the FDA issued an emergency use authorization (EUA) for the investigational monoclonal antibody therapy, bamlanivimab, for the treatment of mild-to-moderate COVID-19 in adults and pediatric patients with positive COVID-19 test results who are at high risk for progressing to severe COVID-19 and/or hospitalization. They also issued an EUS for the investigational monoclonal antibody therapy, casirivimab and imdevimab, administered together, for the treatment of mild-to-moderate COVID-19 in adults and pediatric patients with COVID-19 test results who are at high risk for progressing to severe COVID-19 and/or hospitalization. These therapies may only be administered in settings in which health care providers have immediate access to medications to treat a severe infusion reaction.

During the COVID-19 public health emergency (PHE), Medicare will cover and pay for these infusions the same way it covers and pays for COVID-19 vaccines.

CMS has identified specific codes for each COVID-19 monoclonal antibody product and specific administration codes for Medicare payment:

Q0239

- Injection, bamlanivimab-xxxx, 700mg

M0239

- Intravenous infusion, bamlanivimab-xxxx, includes infusion and post administration monitoring.

Q0243

- Injection, casirivimab and imdevimab, 2400 mg

M0243

- Intravenous infusion, casirivimab and imdevimab includes infusion and post administration monitoring.

Wage Index

RECLASSIFICATIONS AND REDESIGNATIONS AND WAGE INDEX CHANGES AND ISSUES

Each MAC will update their PSF by following the steps, in order, in the file on the FY 2021 MAC Implementation File webpage. For FY 2021, CMS implemented the revised OMB delineations as described in the September 14, 2018 OMB Bulletin No. 18-04, effective October 1, 2020, beginning with the FY 2021 IPPS Wage index.

For FY 2021, the policies below will apply to the wage index:

- Increase the wage index values for hospitals with a wage index value below the 25th percentile wage index value of 0.8465 for FY 2021 across all hospitals.

- Apply a 5 percent cap for FY 2021 on any decrease in a hospital’s final wage index from the hospital’s final wage index in FY 2020.

Hospital Star Rating For CY 2021 and Subsequent Years

Beginning in 2021 CMS will establish, update and simplify the methodology used to calculate the Overall Hospital Quality Star Rating. CMS is retaining certain aspects of the current methodology while updating other aspects. Aspects that are being updated are as follows:

- Combine three existing process measure groups into one new Timely and Effective Care group as a result of measure removals (thus, the Overall Star Ratings would be made up of five groups – Mortality, Safety of Care, Readmissions, Patient Experience, and Timely and Effective Care);

- Use a simple average methodology to calculate measure group scores instead of the current statistical Latent Variable Model;

- Standardize measure group scores (that is, make varying scores directly comparable by putting them on a common scale);

- Change the reporting threshold to receive an Overall Star Rating by requiring a hospital to report at least three measures for three measures groups, however, one of the groups must be specifically be the Mortality or Safety of Care group; and

- Apply peer grouping methodology by number of measure groups where hospitals are grouped into whether they have three or more measures in three, four, or five measure groups (three measure groups is the minimum to receive a rating).These changes will be used to calculate the Overall Star Rating beginning in 2021. Overall, the changes that CMS is finalizing will:

- Simplify the methodology by reducing the total number of measure groups and create an explicit approach to calculating measure group scores;

- Improve predictability of the Overall Star Rating over time through a simple average of measure scores with equal measure weightings that hospitals can better anticipate; and

- Improve the comparability of the Overall Star Rating through updating the reporting threshold, and peer grouping

2021 Annual Update of Per-Beneficiary Threshold Amounts

The per-beneficiary threshold amounts or “therapy caps” are found in a provision of Section 50202 of the BBA of 2018 adds Section 1833(g)(7)(A) of the Social Security Act to preserve the former therapy cap amounts as thresholds above which claims must include the KX modifier to confirm that services are

medically necessary as justified by appropriate documentation in the medical record. There is one amount for PT and SLP services combined and a separate amount for OT services. Medicare will deny claims from providers for therapy services above these amounts without the KX modifier.

The annual per-beneficiary incurred expense amounts are now called the KX modifier thresholds in the Medicare policy for CY2021. These amounts were previously associated with the financial limitation amounts that Medicare more commonly referred to as “therapy caps”.

For CY2021, the KX modifier threshold amounts are:

- $2,110 for Physical Therapy (PT) and Speech-Language Pathology (SLP) services combined, and

- $2,110 for Occupational Therapy (OT) services.

High Throughput COVID-19 Testing

CMS created two new HCPCS codes, effective for dates of service on or after April 14, 2020 for Clinical Diagnostic Lab Tests making use of high throughput technologies.

U0003

- Infectious agent detection by nucleic acid (DNA or RNA); severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID19]), amplified probe technique, making use of high throughput technologies as described by CMS-2020-01-R

U0004

- 2019-nCoV Coronavirus, SARS-CoV-2/2019-nCoV (COVID-19), any technique, multiple types or subtypes (includes all targets), non-CDCIn October 2020, CMS released an amended ruling (CMS 2020-1-R2) that created an add-on payment for COVID-19 CDLTs performed using high throughput technology. This add-on payment can be billed using HCPCS code U0005 effective January 1, 2021.

U0005

- Infectious agent detection by nucleic acid (DNA or RNA); severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) (Coronavirus disease [COVID-19]), amplified probe technique, CDC or non-CDC, making use of high throughput technologies, completed within two calendar days from date and time of specimen collection. (List separately in addition to either HCPCS code U0003 or U0004)

Updated: 12/8/2020 pg. 13

Effective date: U0003 and U0004 were effective for dates of service on or after April 14, 2020. U0005 is effective January 1, 2021. New: 10/16/2020

Disclaimer

These materials are for general informational purposes only. These materials do not, and are not intended to, constitute legal or compliance advice, and you should not act or refrain from acting based on any information provided in these materials. Please consult with your own legal counsel or compliance professional regards specific legal or compliance questions you have.