What you need to know

Subsidies have made health insurance more affordable, with the added benefit of bringing favorable commercial reimbursement rates and contracting leverage to providers. However, these same subsidies are set to expire at the end of 2025. Now is the time for action — providers must advocate for the extension of subsidies to protect tenuous financial margins.

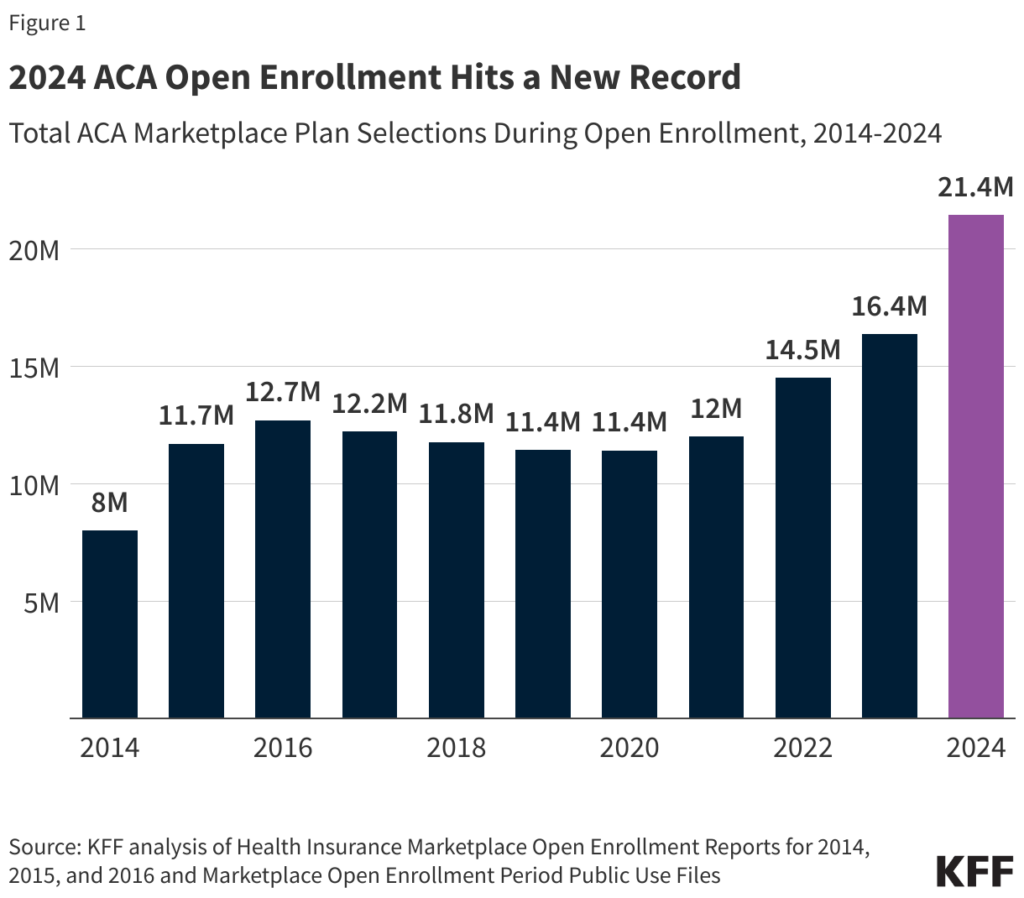

The Affordable Care Act (ACA) has expanded coverage for patients while bringing surprising benefits for providers nationwide. In 2024, 21 million people enrolled in the ACA Marketplace, a record level that’s nearly double the 11 million enrolled in 2020.

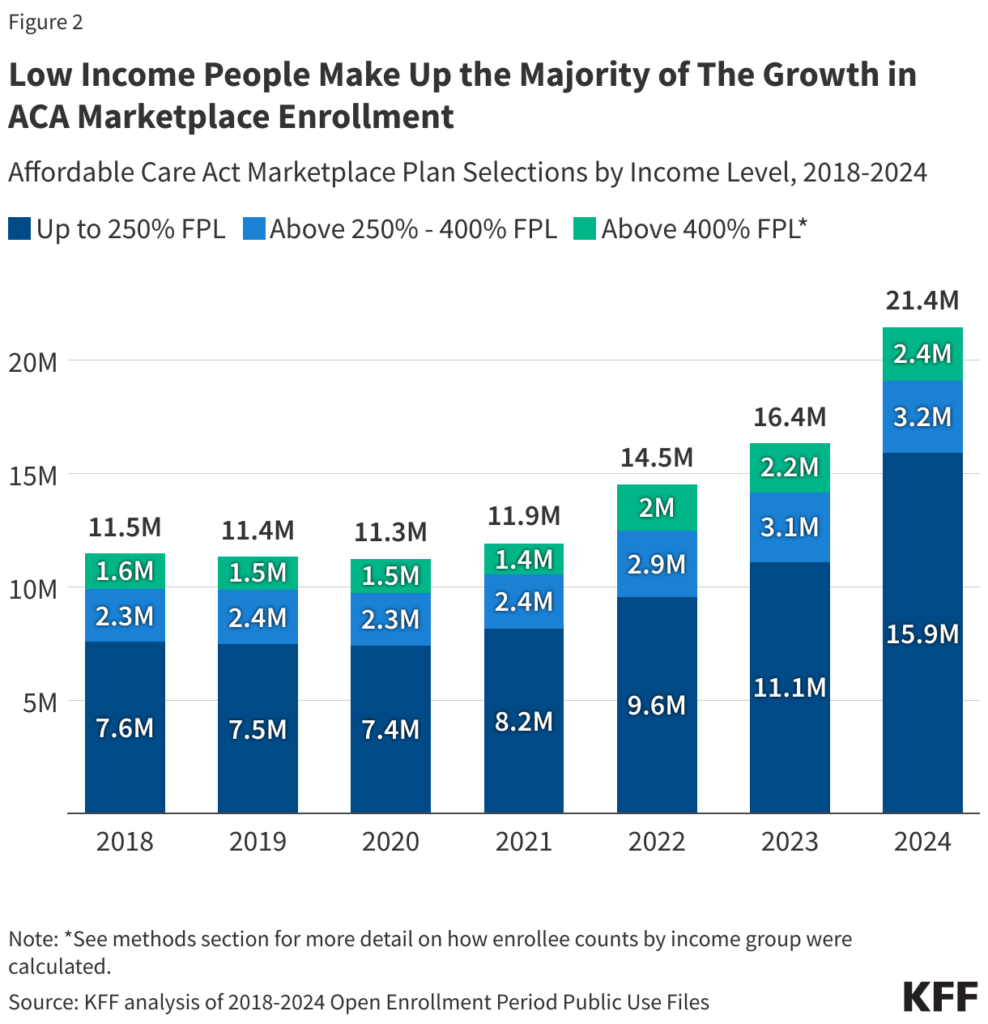

A large portion of this growth can be attributed to the enhanced subsidies introduced during the COVID pandemic by ARPA in 2021 and renewed under the IRA in 2022. These subsidies made health insurance more affordable for all enrollees, but particularly for low- and middle-income individuals who were previously priced out of coverage. In fact, 91% of beneficiaries now receive some form of subsidy, while 74% of beneficiaries are below 250% of the Federal Poverty Level.

This expansion of accessible coverage has had a substantial impact, particularly at a regional level. States with the highest growth in ACA enrollment, such as Texas, Mississippi and Georgia, initially had high uninsured rates and have not expanded Medicaid. This has direct, positive repercussions for healthcare providers and their bottom lines, since many individuals enrolled in ACA plans were uninsured prior to the Affordable Care Act, often because of Medicaid restrictions within their state.

With the introduction of enhanced subsidies, these individuals were able to gain access to insurance plans — and not just any insurance plans, but those with the highest hospital reimbursements. The transition from uninsured to ACA plan enrollment, rather than Medicaid coverage to coverage by an ACA plans, represents the maximum revenue impact on hospitals that can be achieved via payer mix change.

Subsidies drive ACA plan membership — but they’re set to expire.

Subsidies have played a crucial role in making ACA plans affordable. There are two main types of subsidies:

- Premium tax credits: These reduce the monthly premiums for eligible individuals and families.

- Cost-sharing reductions (CSR): These lower out-of-pocket costs for eligible enrollees.

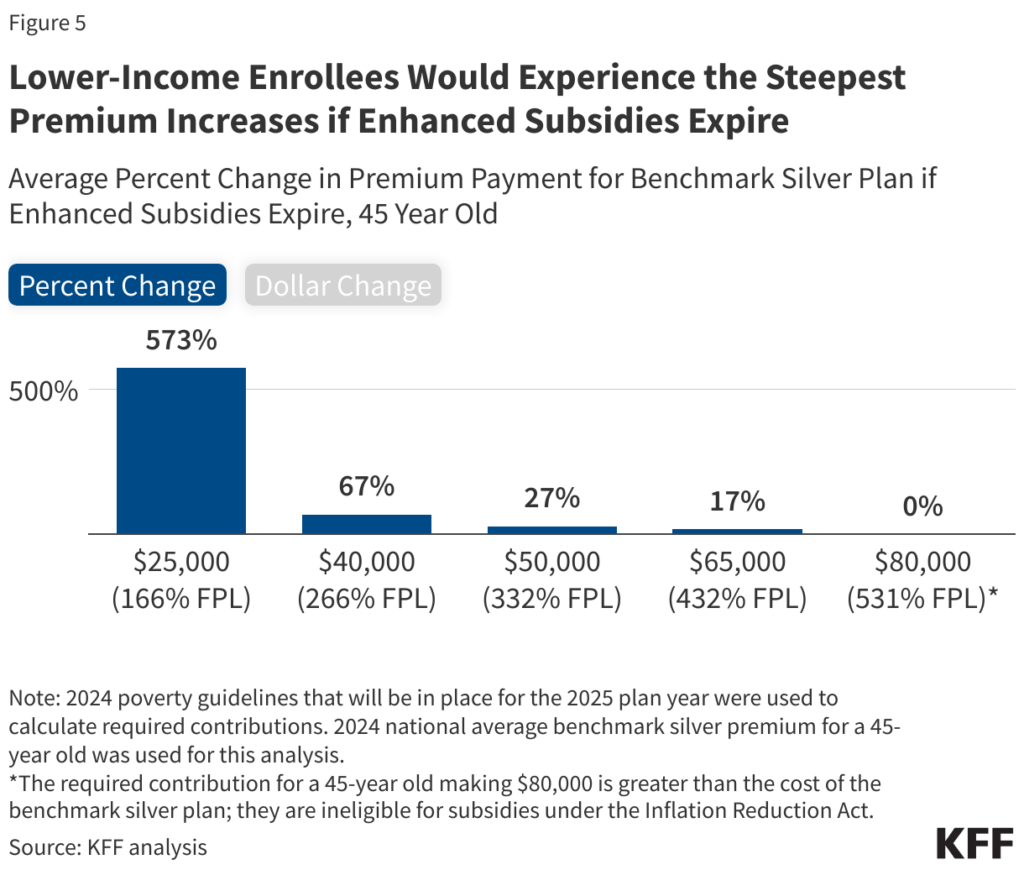

The enhanced subsidies under ARPA and IRA have expanded eligibility and increased the amount of financial assistance available. For example, households with incomes up to 400% of the federal poverty level — $103,280 for a family of three in 2024 — can receive premium tax credits. Those with incomes below 150% of the poverty level can have zero-dollar premiums for silver plans.

Not extending ACA plan subsidies brings clear risks

The enhanced subsidies are set to expire at the end of 2025. If not extended, the following risks may arise, impacting patients, providers, payers and employers alike:

Loss of coverage

Millions of individuals could lose their health insurance coverage, leading to a potential increase in uninsured rates.

Increase in self-funded employer costs

With the subsidies factored in, ACA plans are less expensive than some employer-sponsored plans. If individuals don’t have that option, they will need to move back into the employer-sponsored plans, bringing added to financial burden to those employers.

Revenue impact

Providers could face a significant revenue impact due to the loss of commercially insured patients and a potential increase in uninsured or Medicaid patients.

Market instability

The uncertainty around the extension of subsidies could lead to market instability, affecting both insurers and providers.

Contracting leverage: an overlooked opportunity of ACA plans

The risk of not extending these subsidies is underscored by the opportunities brought to providers by the rapid growth of ACA plan membership. Chief among these is the potential for ACA plans to serve as a means of leverage during contracting.

Providers can take proactive action to capitalize on the recent proliferation of ACA plan enrollments:

- Lean on direct-to-consumer education during open enrollment

The ACA opens new opportunities for contracting leverage through direct-to-consumer marketing during open enrollment. Put simply, during open enrollment, and just like with Medicare Advantage, ACA members can choose their desired plan from a level playing field — a practice distinct from employer-sponsored plans, where coverage options are determined by the employer, not the healthcare consumer.

By aligning the term of the contract with the open enrollment window, providers can leverage the relevance of the contract negotiation against the open enrollment window, communicating with the public the potential reality that their provider will not be participating with a specific payer in the following year and asking them to consider this when making a plan selection.

When dealing with payers that offers both Medicare Advantage and ACA products, both of which have overlapping open enrollment windows, we see a unique opportunity to challenge the payer’s membership at scale while also educating the public on their access options. - Ensure contract rates for ACA are equivalent to the commercial rates

Providers must take inventory of their current ACA contracted rates. Ensure that they are equivalent to that payer’s commercial rates.

This creates a significant revenue opportunity for individuals that were previously uninsured or underinsured and avoids the revenue leakage due to migration from an existing employer-sponsored plan to ACA plans since the ACA plans will be the same contracted rate. - Support lobbying efforts to renew + extend subsidies

Providers hold industry expertise and influence, enabling them to effectively lobby policymakers to recognize the importance of making healthcare more accessible and affordable. Executives should collaborate with advocacy groups, participate in policy discussions and provide data-driven insights that highlight the positive impact of expanded subsidies on public health outcomes and economic stability.

Education is key. Providers can contact their representatives in Congress, invite them to tour the healthcare facilities and show them what has been made possible from the revenue associated with these enhanced subsidies. Care innovations, community impact and other tangible improvements all support a platform that would be easy for politicians to get behind if they are educated on it.

Additionally, providers can mobilize their networks to amplify the message, ensuring that the voices of patients and providers are heard. By actively supporting these lobbying efforts, healthcare leaders can help create a more equitable healthcare system that benefits all stakeholders.

The bottom line

The proliferation of ACA plan membership, driven by enhanced subsidies, has created substantial opportunities for healthcare providers. It has opened new contracting leverage opportunities in the struggle to negotiate fair and adequate reimbursement with payers. However, the potential expiration of these subsidies poses significant risks industry-wide that cannot be overstated.

Stakeholders — including both insurers and providers — must advocate for the extension of these subsidies. The goal is not only to expand care, but to support comparable fee-for-service rates, appropriate reimbursements and the hard-earned margins keeping organizations afloat in an industry facing numerous pressures.